|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

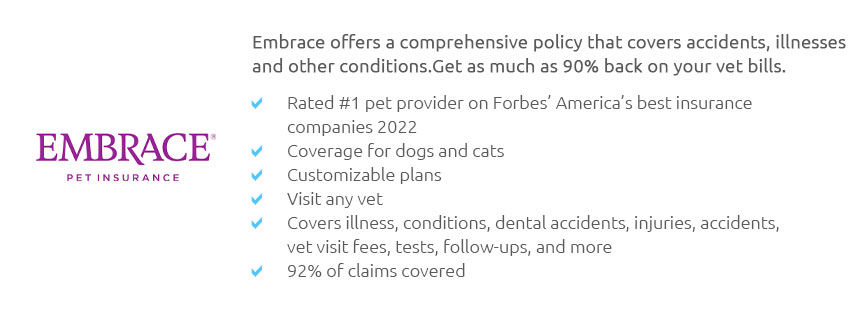

Best Cat Insurance Reviews: Expert Tips and AdviceChoosing the best cat insurance can feel like navigating a labyrinth of options, each promising peace of mind and protection for your feline friend. With a plethora of companies vying for your attention, it's essential to understand what each offers and how they stack up against one another. In this comprehensive review, we'll delve into some of the top-rated cat insurance providers, offering insights into their strengths and weaknesses, and helping you make an informed decision that prioritizes your pet's health and your financial security. Before we dive into specific reviews, let's consider what makes a cat insurance plan truly stand out. Coverage options are paramount, and a robust plan should cover accidents, illnesses, hereditary conditions, and ideally, wellness care. Annual limits, deductibles, and reimbursement percentages are also critical factors to weigh, as they directly impact out-of-pocket expenses. Moreover, the claims process should be seamless and hassle-free, allowing you to focus on your cat's well-being rather than bureaucratic red tape. Trupanion consistently receives high marks for its straightforward approach to coverage. They offer a single, comprehensive plan that covers a wide range of conditions without imposing payout limits. However, their lack of a wellness option might be a downside for those seeking routine care coverage. On the other hand, Healthy Paws is lauded for its no-caps policy on annual or lifetime payouts, ensuring that even the most severe and costly conditions won't leave you stranded. Yet, some users note that their premiums can increase significantly as pets age. Another contender, Petplan, shines with customizable plans and a solid reputation for covering hereditary and chronic conditions. They also offer a unique mobile app that simplifies claim submissions, enhancing user convenience. However, their policies can be more expensive than some competitors, which may deter budget-conscious pet parents. Meanwhile, Embrace stands out for its wellness rewards program, which reimburses routine care costs and helps manage everyday veterinary expenses. Nevertheless, some customers express concerns over their processing times for claims. For those who prioritize affordability, Figo presents a viable option with competitive pricing and a user-friendly app that makes policy management a breeze. Despite these advantages, their coverage options might not be as extensive as some pet owners would like, particularly when it comes to alternative therapies. In conclusion, while each of these providers has its merits, the best choice ultimately depends on your individual needs and priorities. Consider what aspects of coverage matter most to you, whether it's comprehensive care, cost-effectiveness, or ease of use, and select a plan that aligns with your expectations. Frequently Asked Questions

https://www.aspcapetinsurance.com/research-and-compare/compare-plans/compare-pet-insurance-plans/

Check out our pet insurance reviews to see what our customers are saying ... https://www.petinsurance.com/

The best pet insurance ever by Nationwide. Plans covering wellness, illness, emergency & more. Use any vet and get cash back on eligible vet bills. https://www.petsbest.com/

Pets Best offers pet insurance plans for dogs and cats covering up to 90% of your unexpected veterinary costs with no annual or lifetime payout limits and ...

|